Not sure how to begin? Just apply for financing and we will get in touch with you and will discuss all the questions you may have.

How It Works

Project funding procedure

Learn about

Investing via a crowdfunding platform means an opportunity to immediately dispose your available funds (via a bank wire transfer or using a payment institution settlement service), starting from as little as 100 EUR if you are an individual or 300 EUR in case you are a legal entity, as a pool of investments is collected from thousands of registered and compliant Platform users.

Once a pool is completed, reaching its target or minimum amount within a stipulated time period, the Project owner is informed and, upon completion of strict legal procedures, including registration of mortgage in favor of our Agent and providing other additional collateral in some cases, your investment is confirmed and the funds are transferred to the Project owner. Please note that interest income calculation on your investment starts only from that moment.

Thus, your investment is wisely diversified, being spread over numerous attractive offers. We have a variety of investment projects to invest in, most of which are short and middle-term development projects in European countries with real estate collateral (mortgage). As an investor, you can find your own comfort zone, determining maximum investment amount and choosing the reasonable risk-profit ratio.

We provide maximum information about our investment offers in line with the forthcoming EU crowdfunding regulation requirements; however, if you still have any questions or concerns, do not hesitate to ask!

Still, a detailed assessment by yourself of your knowledge in investing and possibilities to beak risks and possible losses, which may arise from the investments made, is highly advisable. Therefore, we strongly recommend to thoroughly read the risk description on our website and to seek for an independent advice of a qualified professional before taking your investment decision.

We are open if your wish our support or advise in this assessment process of your knowledge and experience and determination whether planned investments are or are not suitable for you.

Funding has never been so easy using a crowdfunding platform in a transparent and friendly jurisdiction. Despite the unified, scoring-based approach we perform towards Project ownerâ assessment, we stream for tailor-made solutions, taking into account the individual needs of those that qualify.

The pillars of our cooperation are: 1) the impeccable reputation and payment history of the Project owner; and 2) their ability to handle the âexpensive moneyâ which means that the high interest rate should be justified, thus the project needs to be absolutely self-sufficient and have clear and stable cashflow to maintain loan repayment in time.

For projects with a high value added, in most of cases the âhigh costsâ pertained to crowdfunding are compensated over and above with the other benefits of crowdfunding, including very fast funds raising process and flexibility for those long-run projects that are implemented in stages and therefore require loans in installments, often subject to individual terms and conditions, depending on the other financial tools and models available. Crowdfunding is not always about total substitution of traditional sources of financing; in most of cases it is about complementation of other source(s) of funds available, e.g. bank loans, to the extent the Project owner really needs.

Referral income, provided by the Platform, is your real chance to earn more without any risk at all whether you invest with us or not. All you need to get paid is to be a registered and approved Platform user with a verified bank account.

Referring of Platform services mean a personal or impersonal invitation of other internet users to start using our services. It has a form of a unique link or banner, generated by our system, assigned to your userâs ID and placed in your personal cabinet, Fundroom, for your convenience and perusal. You can share it with other users of your choice by simple âcopy-pastingâ this link and sending it by e-mail or messenger or placing it in social networks or any other internet resources, provided that sharing such links is not prohibited by the policy of the resource.

The referral income will be calculated and automatically credited to your Platform account for each investment, made within a certain period of time by an internet user, registered on the Platform, following the link you had shared. The validity of the placed link or banner, as well as the formula of referral income calculation may be subject to certain terms and conditions though. Please see more information in your personal cabinet.

Kindly note that the Platform retains the right to delete the referral links or banners in case of any violations or reputation risk or suspicions of the above on its own discretion at any time.

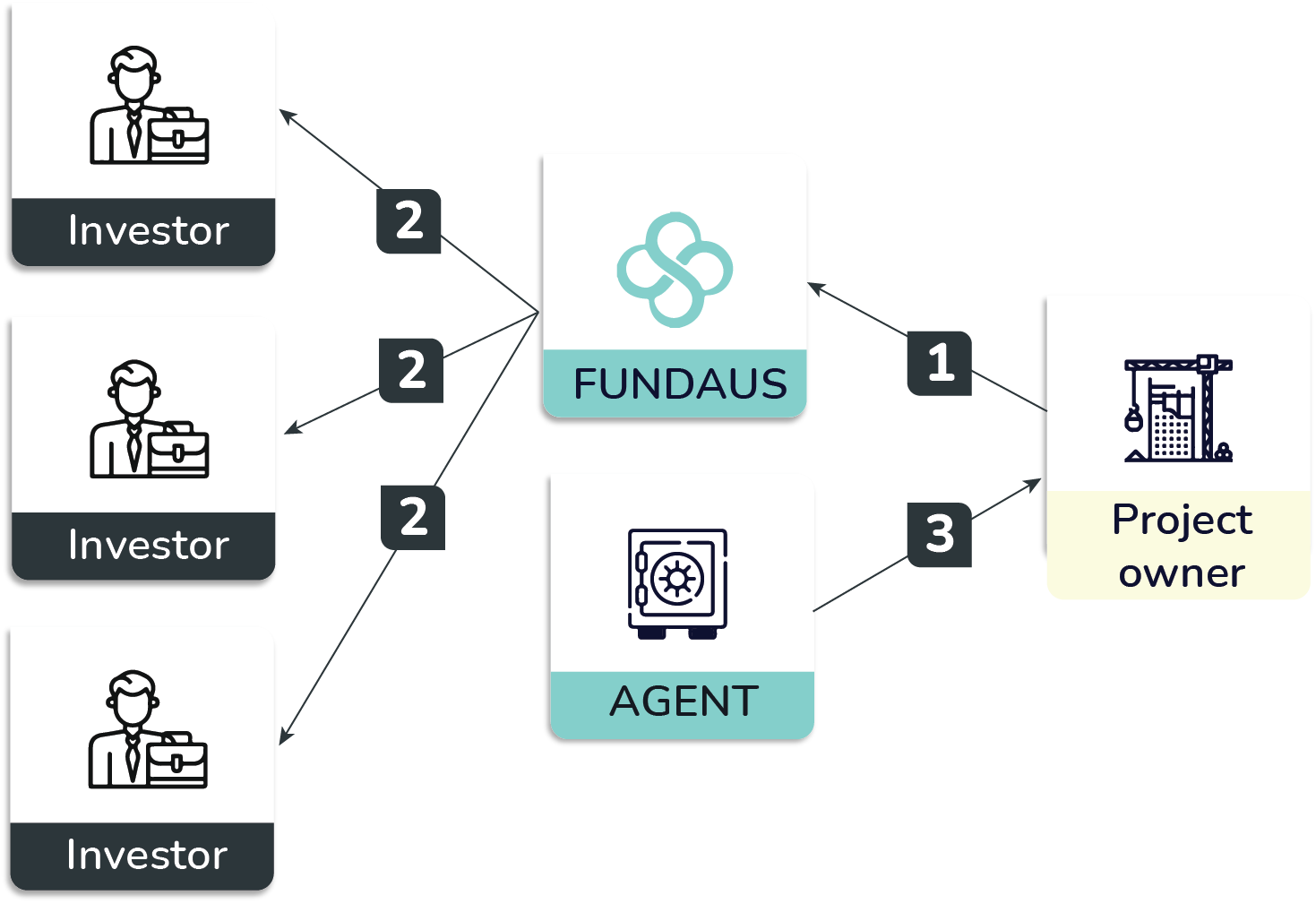

Repayment Process Scheme

- The Project owner repays the Loan to FUNDAUS account

- FUNDAUS repays the investment to the Investor

- The Agent agrees to withdraw the collateral.

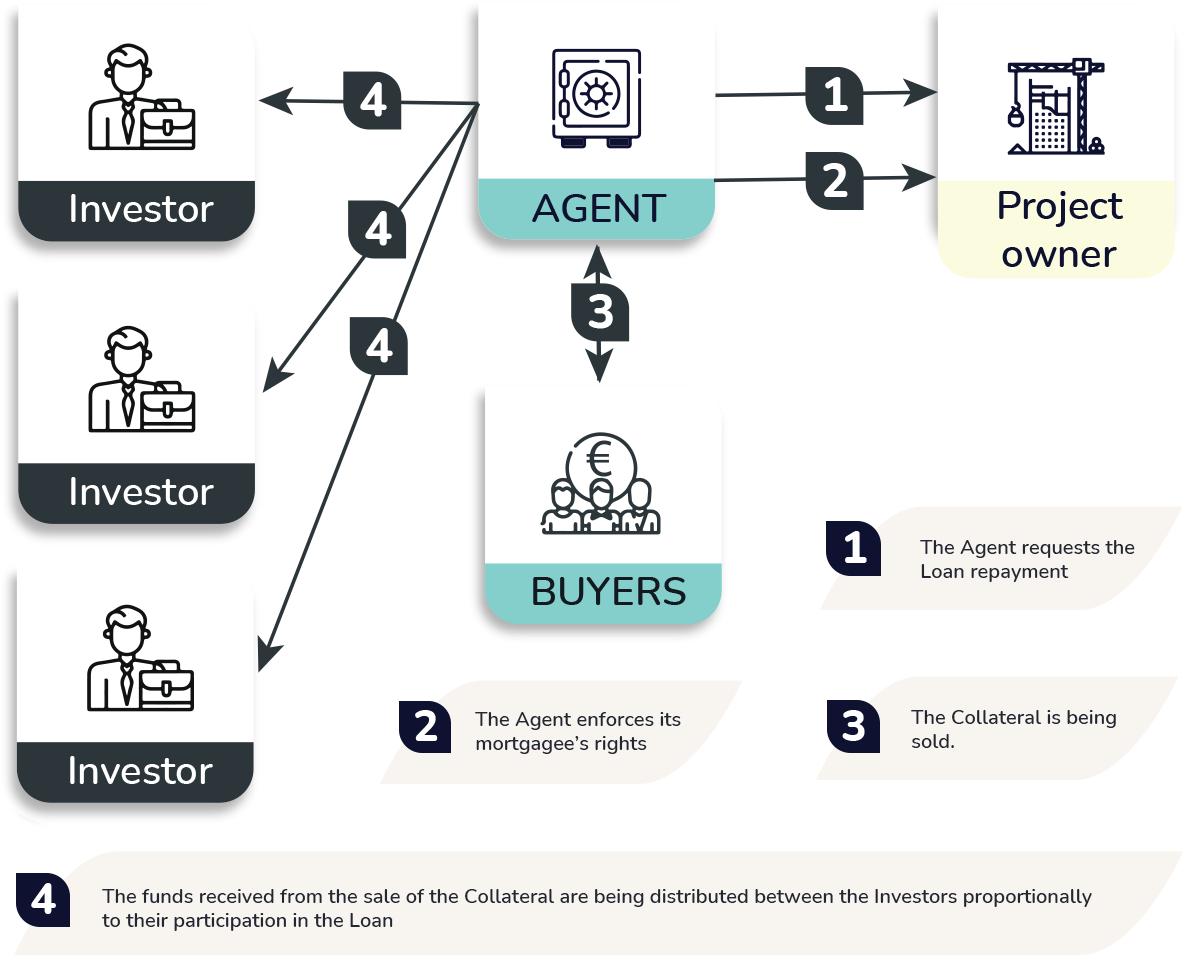

Repayment Process Scheme in Event of Default

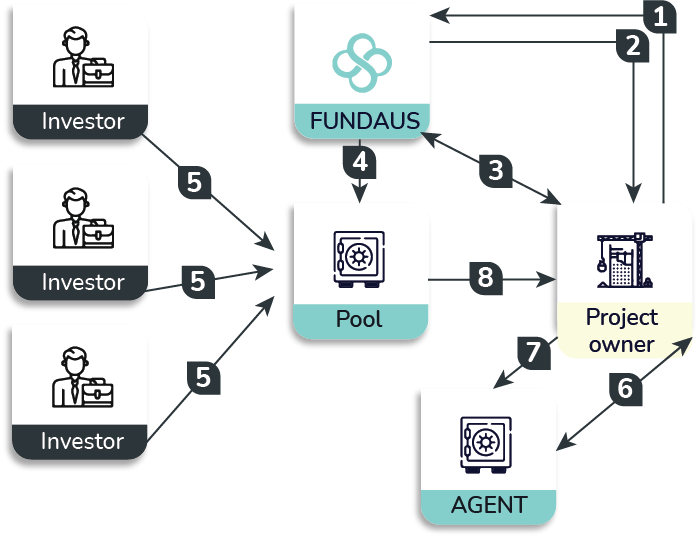

Project Funding Scheme

- The Project Owner applies for funding of its Project

- FUNDAUS makes an assessment of the Project Owner and its Project.

- FUNDAUS and the Project Owner enter into the Agreement.

- FUNDAUS places the Project on the Website

- Investors fund the Project.

- The Project Owner enters into the Loan agreement and the Collateral agreement (Pledgor) with the Agent

- The Project Owner (Pledgor) registers the Collateral in favour of the Agent.

- FUNDAUS disburses the Loan to the Project Owner.